Optimize your fund management and boost operational efficiency with UQPAY's commercial debit and prepaid cards, seamlessly linked to your accounts for transparent, real-time transactions.

UQPAY is dedicated to delivering exceptional financial payment tools to its customers and has now launched commercial debit and prepaid cards to address the diverse financial needs of businesses and institutions.

For daily businesses and organizations expenses.

Pre-allocate budgets for specific purposes, such as employee travel, specific project expenses or employee benefits.

UQPAY provides two modes of cards: SINGLE mode and SHARE mode.

Single Mode

Deposit funds into the card in advance. Supports deposit and withdrawal.

Share Mode

Co-share the funds in account and you can set specific card limit on a card. The card does not support deposit or withdrawal.

Physical Cards can be shipped to cardholders. Our program includes a complete manufacturing process to ensure your card is of the highest quality.

Cards with no physical form, but it includes all the card information needed for digital transactions.

Provide instant payment capabilities to ensure that corporates can quickly respond to market needs and business opportunities.

Include the budget management and expenditure control functions to help enterprises monitor and manage expenditures in accordance to budgets.

Real-time monitoring and management of corporate funds, together with real-time account balance inquiry, transaction record review, etc.

UQPAY's advanced technology ensures a fast and convenient payment experience.

Multiple encryption and risk control measures guarantee fund safety.

Currently focusing on corporate virtual cards, with upcoming physical and consumer cards.

Diverse application scenarios supported for both online and offline transactions.

Institutions can choose to charge and deduct transaction fees from either a cardholder's card or from an institution's account. This offers great flexibility for the institutions to provide services with customized fee structures.

Provide robust APIs for easy integration with existing systems. Customers can easily onboard through institutions following a streamlined and efficient process. This quick and simple onboarding is designed to enhance the customer experience.

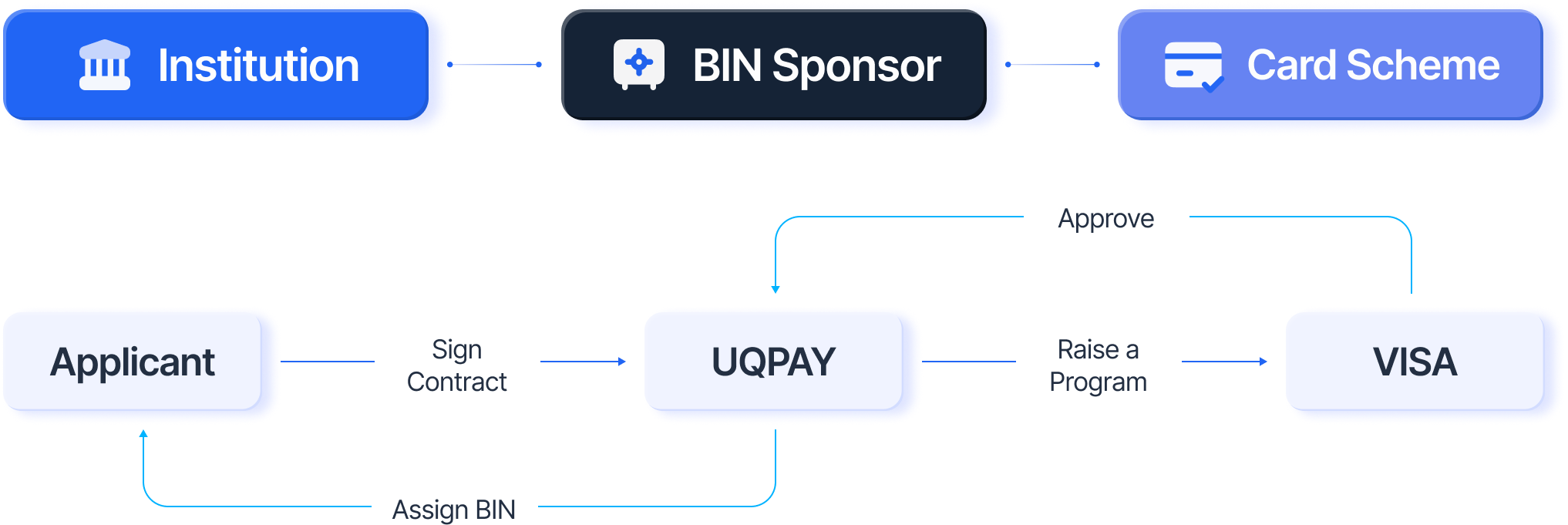

Through the BIN sponsorship service, institutions can swiftly launch their payment products such as prepaid cards, debit cards, etc., without the need to apply directly for membership with card schemes.

3D Secure (3DS) provides an additional security layer for your cardholders when making online payments. Enabling 3DS on your cards reduces the chance of fraudulent transactions and chargeback requests.

Digital wallets support all our card types. Cardholders can easily add either virtual or physical cards to their digital wallets for use with Apple Pay and Google Pay.

Support Multi-currency settlement: Able to settle in multiple currencies.

Provide BIN Sponsorship Service Model: Enable your own card issuing capability.

Co-Brand Card: Co-Brand Cards provide cardholders with benefits and rewards related to the partnering brands.